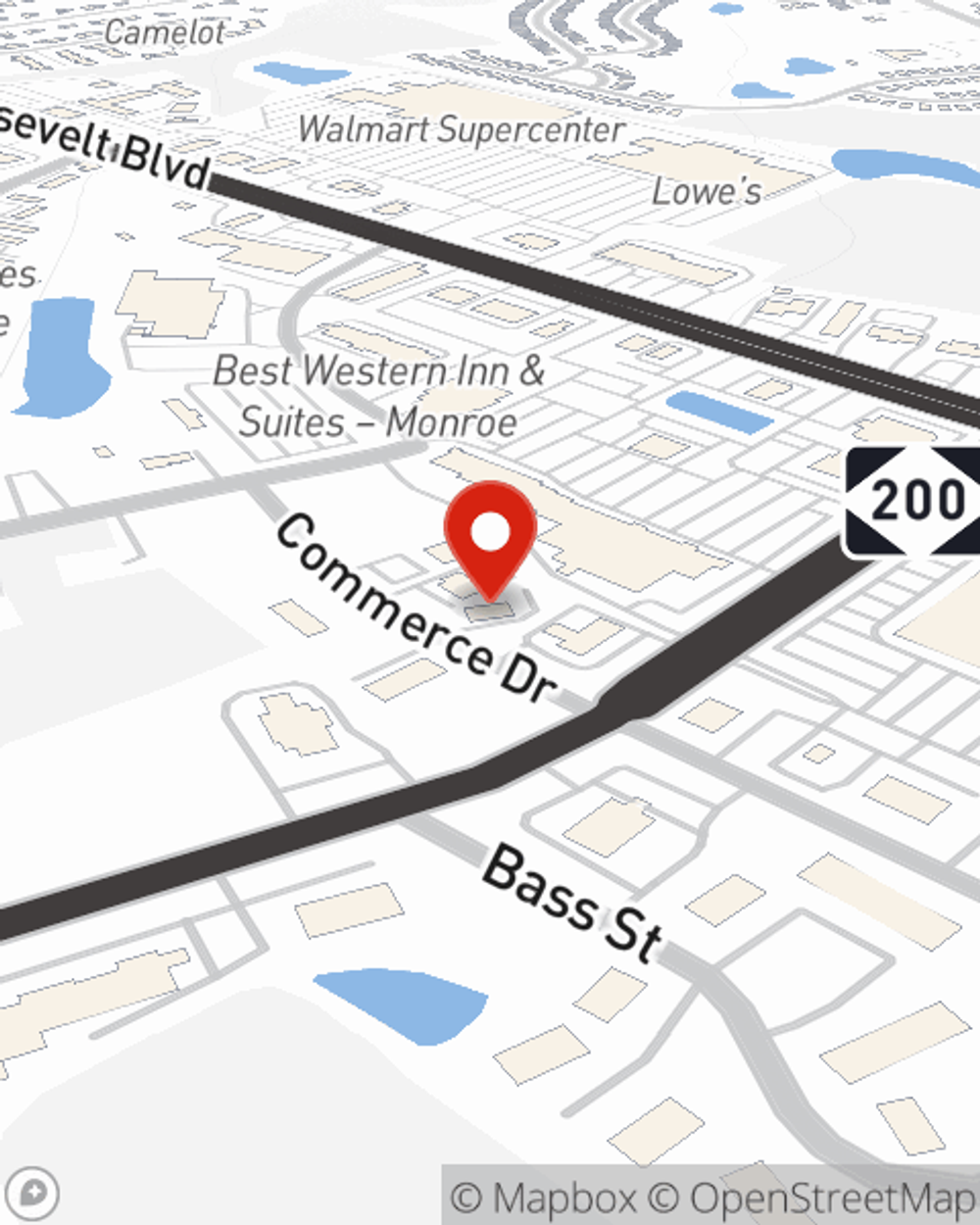

Business Insurance in and around Monroe

Calling all small business owners of Monroe!

Helping insure small businesses since 1935

Insure The Business You've Built.

You've put a lot of elbow grease into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a pet groomer, a confectionary, a window treatment store, or other.

Calling all small business owners of Monroe!

Helping insure small businesses since 1935

Protect Your Future With State Farm

Your small business is unique and faces specific challenges. Whether you are growing a hobby shop or a music school, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your business type, you may need more than just business property insurance. State Farm Agent Josh Mullis can help with worker's compensation for your employees as well as life insurance for a group if there are 5 or more employees.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Josh Mullis is here to help you learn about your options. Get in touch today!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Josh Mullis

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.